When a life-saving drug disappears from pharmacy shelves, it’s not a glitch-it’s a system failure. In 2025, over 200 essential medicines in the U.S. still face periodic shortages, from antibiotics to insulin and sterile injectables. These aren’t random accidents. They’re the result of supply chains that were built for efficiency, not endurance. The good news? We know how to fix this. Preventive measures aren’t just about stockpiling pills-they’re about redesigning how drugs are made, moved, and managed before crises hit.

Why Resilience Matters More Than Cost Savings

For decades, pharmaceutical companies chased the cheapest source for active pharmaceutical ingredients (APIs). China and India supplied over two-thirds of the world’s APIs. It made financial sense-until it didn’t. During the pandemic, border closures and factory shutdowns caused cascading delays. Hospitals ran out of sedatives. Cancer patients missed doses. The cost wasn’t just dollars-it was lives. Resilience isn’t about being expensive. It’s about being dependable. According to ZS Associates, companies with strong resilience strategies avoided $14.7 million in lost revenue per major disruption. The U.S. Department of Defense now classifies drug supply failures as a critical national security risk. If you can’t deliver heart medication during a natural disaster or a geopolitical crisis, you’re not just failing patients-you’re failing the country.The Three Pillars of a Resilient Supply Chain

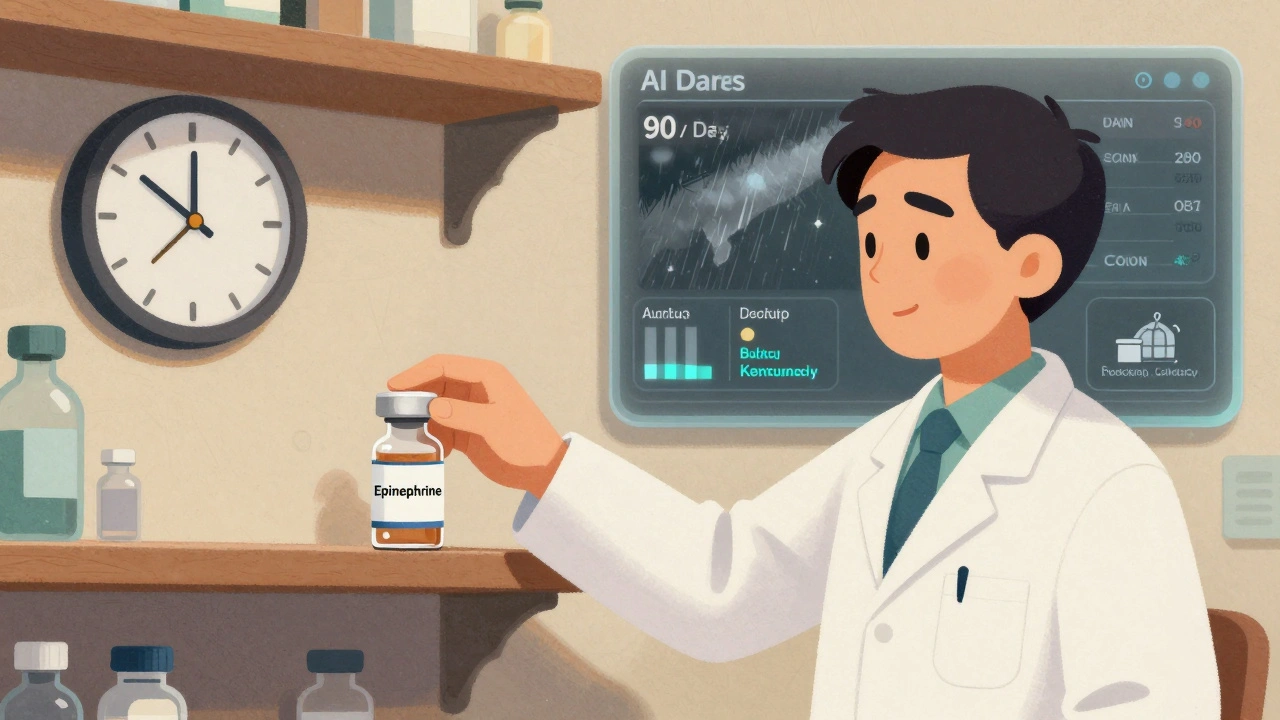

Building resilience isn’t a single fix. It’s three interconnected systems working together: preparedness, response, and recovery. Preparedness means knowing where your vulnerabilities are. Leading companies now map 12 to 15 tiers of suppliers-not just their direct vendors, but the vendors’ vendors. A single broken microchip in a machine in Germany can halt API production in India. Risk assessments now track geopolitical risks, climate disruptions, and even labor strikes. Companies that do this well reduce their blind spots by 70%. Response is about staying operational during chaos. This means having backup plans already in motion. Dual-sourcing is now standard for 70-80% of critical drugs. If your API comes from China, you also have a supplier in Poland or Mexico. Buffer stocks are another key tool. For essential medicines like epinephrine or heparin, keeping 60 to 90 days of inventory isn’t wasteful-it’s insurance. Recovery is how fast you bounce back. This is where technology makes the biggest difference. Continuous manufacturing systems-small, modular units that produce drugs nonstop instead of in batches-can restart within days after a shutdown. Traditional factories take months. The FDA approved only 12 continuous manufacturing facilities as of mid-2025, but that number is rising fast.Technology That’s Changing the Game

Old-school batch manufacturing is being replaced by smarter, faster systems. Continuous manufacturing cuts facility size by 30-40%, reduces energy use by 20-25%, and slashes material waste by 15-20%. It’s not science fiction-it’s happening in plants across Ohio, North Carolina, and even New Zealand. AI is another game-changer. Machine learning models now predict supply disruptions with 85-90% accuracy up to 90 days in advance. They scan weather patterns, shipping delays, customs holdups, and even social media chatter about raw material shortages. One major manufacturer in Tennessee cut quality deviations by 30% using AI to adjust process parameters in real time. Blockchain isn’t just for crypto. Pilot programs using blockchain for drug traceability have reduced counterfeit medicines by 70-75%. When every vial has a digital fingerprint, it’s impossible to sneak in fake insulin or diluted antibiotics.

Regionalization Over Globalization

The era of “make it wherever it’s cheapest” is over. Companies are now building regional networks. North American firms cut their reliance on Chinese APIs from 38% in 2022 to 29% in 2025. Domestic production rose from 22% to 28%. That’s progress-but it’s not enough. The U.S. still produces only 12% of sterile injectables and 17% of antibiotics domestically. That’s dangerous. The government’s 2025 Strategic Active Pharmaceutical Ingredients Reserve aims to fix that. By 2027, it plans to stockpile 90 days’ worth of 150 critical medicines. The $1.2 billion from the CHIPS Act and $800 million more in the 2025 budget are being used to fund new manufacturing sites in states like Kentucky and Pennsylvania. But regional doesn’t mean isolated. The smartest companies are building networks across three to four regions: North America, Europe, Southeast Asia, and Latin America. This avoids overdependence on any single country. If a flood hits a factory in India, production can shift to Mexico or Ireland without skipping a beat.The Cost of Resilience-and Why It’s Worth It

Yes, resilience costs more. Building a continuous manufacturing facility runs $50-150 million-three to five times the price of a traditional plant. Investing in buffer stock adds 8-12% to the cost of goods sold. Some executives push back: “Why spend more when we’ve gotten by for years?” Because the alternative is worse. A single shortage of a critical drug can cost a hospital $500,000 in emergency purchases, overtime, and patient transfers. A 30-day shortage of a cancer drug can trigger lawsuits, reputational damage, and lost market share. Companies that invest in resilience see a 1.8x return on investment within three years-mostly from avoided losses. The real savings? Trust. When patients know their medication will be there, they stick with treatment. When doctors don’t have to scramble for alternatives, care improves. That’s not a KPI-it’s a moral imperative.

What’s Holding Companies Back?

The biggest barrier isn’t money-it’s culture. Seventy-eight percent of companies still operate in silos. Supply chain teams don’t talk to R&D. Finance won’t approve long-term investments. Regulatory teams fear change. One large pharma company reduced decision time by 50% during a crisis by creating a cross-functional resilience team with real authority. Data is another problem. Sixty-five percent of companies can’t see their full supply chain in one system. If you don’t know where your API is made, how can you protect it? Regulatory uncertainty is real. The FDA has approved only 12 continuous manufacturing facilities in over a decade. But in 2025, they cut approval timelines from 36 months to 18. That’s a signal: change is coming.What You Can Do Today

You don’t need a billion-dollar budget to start building resilience.- Map your top 10 critical drugs-find where their APIs come from. If all are from one country, you’re at risk.

- Identify one dual-sourcing opportunity-find a second supplier, even if it’s slightly more expensive.

- Build a 30-day buffer for at least one life-saving drug. Start small. Scale later.

- Ask your suppliers for transparency-do they have backup plans? Do they track their own suppliers?

- Push for cross-team meetings-bring together procurement, quality, and logistics once a month. Talk about risk, not just cost.

The Future Is Already Here

By 2027, 45-50% of new manufacturing capacity will use continuous production. By 2030, 65-70% of U.S. drugs will come from regional networks-not just one global hub. The industry is shifting. The question isn’t whether you’ll adapt-it’s how fast. Resilience isn’t about fear. It’s about responsibility. Every pill that reaches a patient’s hand is the result of a chain of decisions. Make those decisions with foresight, not panic. Build systems that don’t break when the world does. Because when it comes to medicine, there’s no backup plan for a life lost.What causes drug shortages in the pharmaceutical supply chain?

Drug shortages are typically caused by manufacturing disruptions, raw material shortages, regulatory delays, natural disasters, or geopolitical events. Over 80% of active pharmaceutical ingredients (APIs) are produced overseas, with China and India supplying 68% of global production. When a single factory in one country shuts down-due to quality issues, labor strikes, or trade restrictions-it can ripple across the entire supply chain, leaving hospitals without critical medications.

How can buffer stock prevent drug shortages?

Buffer stock means keeping extra inventory of essential medicines-typically 60 to 90 days’ worth. This acts as a safety net during production delays, shipping disruptions, or sudden spikes in demand. For drugs like epinephrine, insulin, or antibiotics, even a few weeks of extra supply can prevent a full-blown shortage. The U.S. Strategic Active Pharmaceutical Ingredients Reserve is building exactly this kind of buffer for 150 critical medicines by 2027.

What is continuous manufacturing, and why is it better?

Continuous manufacturing produces drugs in a constant, uninterrupted flow instead of in batches. It’s faster, uses less space, cuts energy use by 20-25%, and reduces waste by 15-20%. It’s also more flexible-factories can restart within days after a shutdown, while traditional batch plants take months. The FDA has approved 12 such facilities as of 2025, with approval timelines now cut from 36 months to 18 months, making adoption easier.

Is onshoring pharmaceutical manufacturing the solution?

Onshoring helps-but it’s not a silver bullet. The U.S. now produces 28% of essential medicine APIs domestically, up from 22% in 2022. But building all manufacturing in one country creates new risks: labor shortages, single points of failure, and higher costs. Experts warn that over-reliance on domestic production can raise drug prices by 20-30% without improving reliability. The best approach is regional diversification-having suppliers in North America, Europe, Southeast Asia, and Latin America.

How do AI and blockchain improve supply chain resilience?

AI predicts disruptions up to 90 days in advance by analyzing global data like weather, shipping delays, and political events-cutting response time by months. Blockchain creates tamper-proof digital records for every drug batch, making it nearly impossible to introduce counterfeit medicines. Early pilots show a 70-75% drop in fake drugs when blockchain is used. Together, these tools turn reactive supply chains into proactive, transparent systems.

Larry Lieberman

December 7, 2025 AT 21:49Iris Carmen

December 9, 2025 AT 19:39Lisa Whitesel

December 11, 2025 AT 15:19Shubham Mathur

December 12, 2025 AT 02:40Guylaine Lapointe

December 13, 2025 AT 21:18Raja Herbal

December 15, 2025 AT 04:09Ruth Witte

December 15, 2025 AT 21:11Jennifer Blandford

December 16, 2025 AT 10:49Mona Schmidt

December 17, 2025 AT 06:50Andrea Beilstein

December 19, 2025 AT 03:23William Umstattd

December 20, 2025 AT 06:06